Concern over diesel prices is beginning to rise in the market even as there are some indicators that may signal some moderation.

The tight diesel market and the fact that inventories “days cover” is down to less than 26 — an extremely low number but one that does not mean “we are going to run out of diesel in 25 days” — has led to a significant overreaction in much of the discourse about diesel supply.

On Monday, a tweet of a highway sign in Pennsylvania noting that a nearby rest stop was out of diesel was widely circulated as evidence the market was in full-blown crisis. But as GasBuddy reported, the issue was a technical one at that stop. After the technology problem was fixed, diesel sales resumed.

Good news for consumers might be found in the market Monday, when prices fell after two days late last week of significant increases. They also can look to East Coast inventories that rose according to the latest weekly report, even as a key national indicator could be measured in a different way. Not all signs are pointing up, nor are they all pointing down.

The up-and-down course of the recent market can be seen in the movement of the ultra low sulfur diesel (ULSD) contract on the CME commodity exchange. After four days of flat-to-down movement between $3.65 and $3.70 per gallon, prices soared Thursday and Friday to settle the week at $3.9148 per gallon after almost crossing the $4 level Thursday.

But trading Monday could be seen as good news for diesel buyers. ULSD declined 13.37 cents a gallon Monday to settle at $3.7811. More significantly, the spread between crude and diesel narrowed.

That movement — albeit one day’s worth — is significant because a good chunk of the increase in diesel prices over the past several weeks has been diesel outperforming crude benchmarks and at a faster pace than gasoline. For September, a simple spread between the front month price of Brent crude and ULSD averaged about $1.25 per gallon. Depending on how you measure it since then — for example, not counting the crazy market at the end of the month when the November contract was expiring — the average has run between $1.60 and $1.65 a gallon. The spread Monday was back down to about $1.25 per gallon.

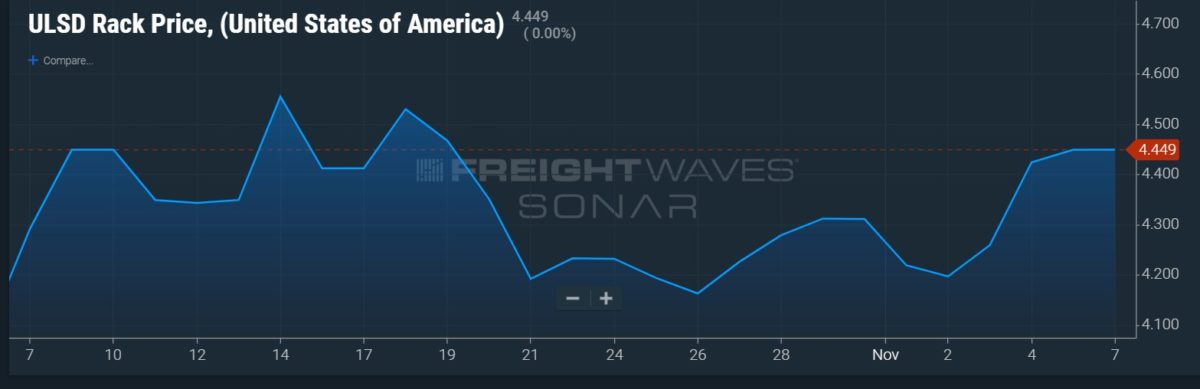

Given the volatility in the market, the average retail price of diesel published Monday by the Energy Information Administration of the Department of Energy, the basis for most fuel surcharges, seemed almost an afterthought. Its relatively small upward move of 1.6 cents to $5.333 per gallon exhibits the dilemma retailers have in a market like this. When the wholesale prices they pay whipsaw up and down, day after day (as evidenced in the ULSDR.USA data feed in FreightWaves SONAR, which tracks the national average wholesale diesel price), where should a retailer put its price from one day to another?

The $3.7811 front-month ULSD settlement Monday is only a few cents more than where it settled Oct. 20. But during that time, it soared as high as more than $4.33 per gallon at the end of October, when the November contract was being squeezed prior to expiring at the end of trading Oct. 31.

One market that has had a bearish impact on diesel has been natural gas, but that may be coming to an end.

The Henry Hub natural gas futures price on the CME commodity exchange settled below $5 per thousand cubic feet (Mcf) Tuesday. But since then, as long-range forecasts are projecting significantly colder weather in the U.S., prices have climbed, with the front-month price Monday settling at $6.944/Mcf, a huge one-day increase of 54.4 cents/Mcf.

With warmer weather having been dominant in the U.S. for the past several weeks, it teamed with the same conditions in Europe to push down both American and European natural gas prices, a bearish factor for diesel. Diesel or certain other distillates like heating oil can be used as a substitute for natural gas both in heating and industrial applications — and lower natural gas prices make that less likely.

That is why price increases in both the Henry Hub (a physical delivery point in Louisiana) and TTF Dutch natural gas market are a source of concern. In addition to the increases in Henry Hub, the TTF price was more than $36 per million BTUs Monday after being as low as $30 just a week earlier.

Natural gas Inventories in Europe have exceeded the most optimistic forecasts. Ira Joseph, a longtime natural gas analyst now with the Center on Energy Policy at Columbia University, tweeted Monday that natural gas inventories are still rising at a time of year when they would normally draw.

Last week, in its quarterly earnings call with analysts, the management of TravelCenters of America (NASDAQ: TA) addressed analyst questions about the diesel market as one of the largest sellers of the fuel in the country.

On the call, CEO Jon Pertchik conceded that “there is a lot of noise out there” about diesel shortages. Recalling similar fears in the spring about East Coast supplies, he added that the chatter is “maybe a little louder this time.”

And with TA, like other major fuel stops, being the majordomo of buyers, Pertchik is likely to have a degree of confidence that not every other buyer might possess.

“We have a pretty high degree of confidence that if we go dry anywhere, it will be infrequent and short-lived and very sort of focused [on] certain key areas or certain specific areas,” Pertchik said. “We do not expect … protracted outages where we go dry. If they happen, they’ll be very focused and in very limited areas and for relatively short periods of time. The way we purchase fuel, our contracts both short and long term, give us a level of protection.”

But the latest inventory report of the EIA was cause for more concern. While the East Coast inventories of ULSD rose more than 7 percentage points, they were still at about 63% of the five-year average excluding 2020. However, that number was below 60% a week earlier.

Conversely, inventories of all distillates — the stocks that have been the focus of the “we’re going to run out in 25 days” chatter — have declined to less than 79% of the five-year average for the fourth weekly report of October from about 84.3% in the first week of the month.

More articles by John Kingston

Winter’s coming and that could have major impacts on already soaring diesel market

DOE methodology for determining diesel prices sees 2 key changes

Tight inventories push diesel past crude, gasoline; OPEC cuts secondary

The post EIA diesel benchmark rises as other market factors point divergently appeared first on FreightWaves.

(@GasBuddyGuy)

(@GasBuddyGuy)