Welcome to Check Call, our corner of the internet for all things 3PL, freight broker and supply chain. Check Call the podcast comes out every Tuesday at 12:30 p.m. EST. Catch up on previous episodes here. If this was forwarded to you, sign up for Check Call the newsletter here.

Inside this edition: Accessibility training for visually impaired freight brokers; California continues to be complicated; and GXO sets the bar high.

Accessibility for all. The Cincinnati Association for the Blind & Visually Impaired (CABVI) and the Transportation Intermediaries Association (TIA) have implemented a workforce development program to train blind and visually impaired individuals to work as brokers. The course, TIA’s New Employee Orientation, will allow students to learn the fundamentals of supply chain and freight management, such as logistics, sales and customer retention skills, that will help them find employment in the brokerage industry, the groups said.

The Backstory. In 2022, CABVI acquired Florida-based Route Transportation & Logistics as part of an effort to offer freight-oriented job opportunities to those with vision loss. Route’s “remote-first” approach eliminates concerns about mobility, a common work barrier to the visually impaired.

Quotable moment from Teri Shirk, CEO and CABVI president: “This partnership with TIA will allow CABVI to train individuals with vision loss in transportation and logistics, even if they don’t have experience. The training will provide new opportunities for career advancement in knowledge-based jobs. We hope that 50% of all new job postings can be filled by those who are blind or visually impaired.”

We love accessibility for everyone. There’s plenty of freight to go around, might as well give others the same opportunity to grow and develop in their careers.

In other slightly less uplifting news, California has started 2023 with a bang. The state updated its regulations for trucks. As of Jan. 1, no vehicles with engines made in 2010 or earlier can be on the road. The vehicle can be older but it has to have an engine newer than 2010. There are about 37,000 trucks registered in the state of California that are anticipated to be affected by this new regulation. This regulation also applies to trucks and buses entering the state for work as well.

The AB5 battles wages on. AB5 will have been in effect for a year as of June 30 this year, thus altering the makeup of independent contractors and how enterprise carriers use them. The U.S. Departmnet of Labor Secretary Marty Walsh swung by Los Angeles to have a chitchat that focuses on collective bargaining relationships between truck drivers and employers. Walsh is advocating for reducing the amount of “misclassified drivers” hauling for the ports.

There is some disagreement as to whether the industry needs a collective bargaining proposition. Matt Schrap, CEO of Harbor Trucking Association, has said that “not every good-paying driving job requires collective bargaining. It is unfortunate that when it comes to our labor department leaders there is a single focused, one sided discussion that dominates any dialogue regarding drayage drivers and what they do … there is more to the story than the ‘misclassification’ narrative.”

I would love to know more about the misclassification narrative Schrap is referring to. If it’s more than operation issues at the port, let a girl know. I’m all for anything that gives people the jobs they want in an environment they want to do them.

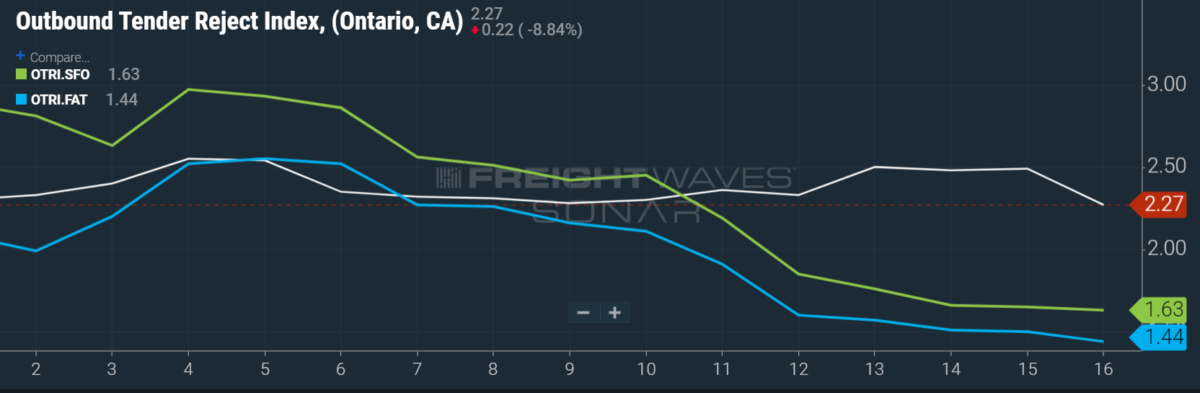

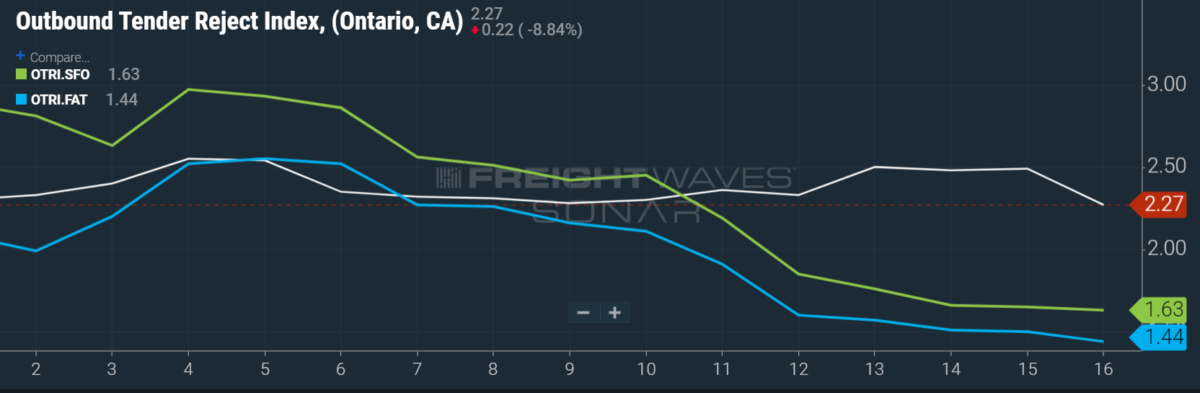

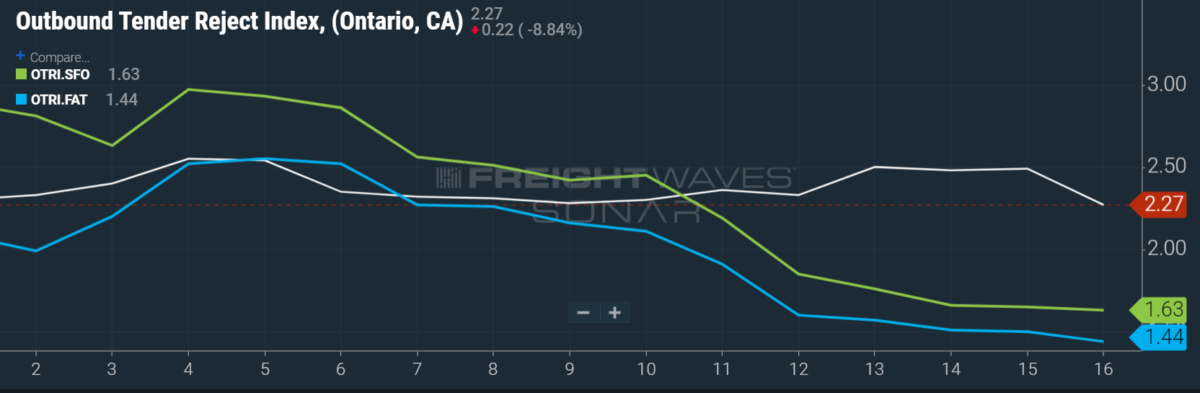

Market Check. The new California regulation went into effect banning the use of engines made in or before 2010 on the roads. By some shock, capacity has not been massively constrained as a result. All throughout California there is almost 98% tender acceptance, meaning the current impact from this new regulation is fine, in terms of freight moving. For once it’s not the end of the world with a new California regulation going into effect.

How’d the lemonade stand do? GXO Logistics Inc. expects to nearly double its revenue and triple its adjusted earnings by 2027 as it foresees increasing demand for its services. That’s the kind of bold statements we like to see as 2023 kicks off. It is expecting to grow revenue by 8%-12% annually through 2027. GXO was spun off from XPO in 2021 and is the world’s largest pure-play contract logistics provider. After the impressive announcement, stock prices rose 6.5% to $52.11. Here’s hoping GXO delivers on these earnings the same way it delivers on freight.

The more you know

Delivery drivers to share $5.6M in misclassification case victory

Collaboration must be key for railroads to thrive, experts say

Freight outlook for January is grim but seasonal

The post Check Call: Accessibility for all appeared first on FreightWaves.