The nation’s largest rail union, SMART Transportation Division, declined Monday a contract proposal in part brokered by the White House, putting the potential of a national railroad strike back on the table next month. The U.S. narrowly avoided a strike in September, which experts said would send a polar vortex-like shock though the supply chain.

Representing about 28,000 conductors, SMART-TD narrowly rejected (50.8% against) the contract following record voting turnout.

The engineers union, Brotherhood of Locomotive Engineers and Trainmen – the second largest rail union – voted in favor of the contract on Monday. The conductors union and the engineers union make up about half of the unionized labor force, but rail unions have what is generally referred to as a “me too” agreement where the terms agreed to by the last holdout will trickle down to all the others, and if all 12 unions don’t agree, then all 12 could potentially strike.

“This can all be settled through negotiations and without a strike,” SMART-TD President Jeremy Ferguson said via statement. “A settlement would be in the best interests of the workers, the railroads, shippers and the American people.

“The ball is now in the railroads’ court. Let’s see what they do. They can settle this at the bargaining table. But, the railroad executives who constantly complain about government interference and regularly badmouth regulators and Congress now want Congress to do the bargaining for them.”

SMART-TD could strike Dec. 9, or the rail carriers could lock out workers, unless Congress intervenes.

The rail industry last went on strike in 1991, a national work stoppage that lasted a day before Congress intervened. The following year, a walkout at USX by members of the International Association of Machinists spread nationally and lasted about two days before Congress, again, intervened.

Operating over a nearly 140,000-mile network in 49 states, the Association of American Railroads projects lost economic output due to a national rail shutdown could be more than $2 billion per day.

To offset the loss of freight flow from a rail strike, American Trucking Associations estimates the U.S. would need more than 460,000 additional long-haul trucks every day to offset the idling 7,000 long distance daily freight trains, “which is not possible…,” ATA President and CEO Chris Spear said in September.

An un-Merry Christmas?

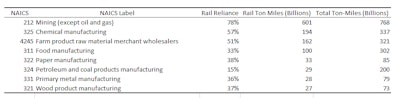

The 2017 Commodity Flow Survey shows the 8 industries most reliance on rail transportation on a ton-mile basis.Compiled by Jason Miller

The 2017 Commodity Flow Survey shows the 8 industries most reliance on rail transportation on a ton-mile basis.Compiled by Jason Miller

When a strike seemed imminent in September, there was much concern that its impact could be disastrous for holiday shoppers, but the eight industries with the most reliance on rail transportation on a ton-mile basis are coal mining; chemical manufacturing; farm product raw material wholesalers (firms that are selling corn, soybeans, etc.); and food manufacturing – “something that hasn’t received as much attention as it likely deserves,” said Jason Miller, Interim Chairperson and Associate Professor of Logistics in the Department of Supply Chain Management at the Eli Broad College of Business at Michigan State University.

“Biggest change with a December date is Christmas presents,” Miller added. “UPS is a huge user of intermodal freight, so I could see many holiday presents getting snarled up in a strike.”

In the days leading up to the Sept. 15 strike deadline, railroads began to deny service for perishable freight, hazardous materials and other types of cargo they didn’t want sitting unattended in the event of a work stoppage – clues that triggered a lot of calls to for-hire carriers and freight brokers, according to DAT. Shippers and their carriers/logistics partners are generally more prepared with contingency plans this time around despite skepticism that Congress would allow any type of disruption.

“I would expect conditions similar to what we saw in September. At that time the effect on the spot market was negligible because contract carriers had plenty of capacity to absorb extra volume from shippers concerned about a strike,” said Dean Croke, principal industry analyst, DAT Freight & Analytics. “Today, demand is softer and the spot market is even more oversupplied with trucks. A full-on strike would be a different story, though, and would be a polar vortex-level shock to capacity across the entire truckload freight market.”